Komsec

33 Posts , Viewing posts 21 to 30

Virtual Annual General Meetings still allowed in 2023

The Companies (Miscellaneous Provisions) (Covid-19) Act came into being during the Pandemic when restrictions on travel within Ireland, flights into Ireland and inability to attend public gatherings led to fairly substantial practical problems for many companies. The implementation of the Act resolved some of those problems not least being the ability for a company to convene its Annual General Meeting virtually.

In December 2022 the Government announced the extension of some parts of the Act to the end of this year (31.12.2023). In particular, certain company meetings (including Annual General Meetings) can still be held virtually. This will be welcome news to many companies who prefer this format although there is nothing to stop a company holding a physical meeting if they wish to do so.

The public can no longer access beneficial ownership information

One of the biggest talking points at the time the Beneficial Ownership Register was put in place was the fact that the public could access it. This meant the public could see the names of the beneficial owners, what percentage shareholding they might hold and even their dates of birth and home addresses!

All that has now changed further to an unexpected European Court Judgment last week. Its ruling means that from now on only 'Designated Persons' can search the Register and obtain beneficial ownership details.

From a practical point of view, the ruling will not affect the vast majority of companies. They are still obliged to ensure both their internal and external Beneficial Ownership Registers are completed in full and kept up to date. The banks as a 'Designated Person' will continue to be able to search the Register and (in our experience) refuse to/delay providing credit facilities to companies if they have queries over the information lodged.

In summary, even if Joe Public can no longer have a peep, there is still no excuse not to register your Beneficial Ownership information and keep it updated!

New Charities Classification System

Charities Classification System

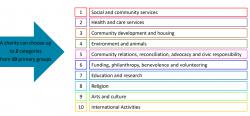

The Charities Regulatory Authority launched a Classification System on 14th November 2022 (as part of Charities Week) which broadly mirrors classification systems in other jurisdictions.

The purpose of the system is to improve functionality of the Charities Register, provide clarity on registered charities, improve data for research.

Charities to self-determine classification and rely on a “best fit” as it is not possible to achieve a perfect system. It is important to note that Classification will not put a limit on the types of activities a charity can carry out to further their charitable purpose.

How does it work?

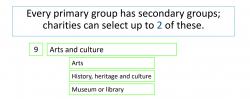

In the example provided by the Charities Regulator, a museum for example would choose category “Arts and Culture” and can then select two secondary groups “History, heritage and culture” and “Museum or library”.

How to search charities using the classification System

A search facility will be introduced when the database is populated. This will be of benefit to funders, researchers and potential volunteers.

What should charities do now?

• Directors to agree on classification and record decision at a Board Meeting.

• Log into MyAccount to complete and submit form

• Once off process (unless charity wishes to amend it in future)

• Automatic registration of classification

• Immediate update to Register of Charities

More Information

There’s a new Classification Section on their website with more information which includes:

CORPORATE ENFORCEMENT AUTHORITY - different name – no difference?

The Corporate Enforcement Authority (established in July 2022) replaced the Office of Director of Corporate Enforcement (ODCE) which was no longer fit for purpose. With the creation of the CEA it would be easy to think same old, same old.

It seems to me that the CEA has seized the opportunity to morph into a much more dynamic, focused, and independent organisation which has hit the ground running. Personally, I think one of the most important developments for the CEA is its ability to control its own recruitment requirements so that it can source specialist staff capable of dealing with the intricacies of corporate crime.

White collar crime sounds quite bland but as far as I am concerned it is just as bad as any other crime. A corrupt director may not have physically knocked over an old lady to steal her handbag but stealing the old lady’s pension is worse. I was never a great advocate of the “walk of shame” one saw for alleged corporate criminals in other jurisdictions but, have to admit I am beginning to think there is some merit in seeing the public arrest with HANDCUFFS of individuals accused of corporate crime.

According to the United Nations it is estimated that US$1 trillion is paid in bribes and US$2.6 trillion stolen through corruption. Combined these sums represent 5% of annual Global Gross Domestic Product.

This year the Irish Government gave one of the biggest Budgets in the history of the State with commentators saying it was made possible by income from Corporation Tax. Whatever one thinks of the Budget if Ireland does not maintain a reputation as a strong reputable country to do business in there will be no Corporation Tax to argue about. There are more than enough challenges for Irish companies dealing with the devasting war in Ukraine, energy costs, housing, climate, etc. Without a strong corporate reputation Ireland will no longer attract business and once a reputation is lost the way back is grindingly hard for everyone.

An effective CEA will be to the benefit of us all.

Annual Returns - Prepare to file

The majority of companies in Ireland have an Annual Return Date of 30th September so to avoid getting caught out start preparing now.

-

Check status of your company’s filing in the Companies Registration Office is correct

-

Check if any of the directors have changed their personal details. The two most common changes are where directors have changed home address or their list of directorships are not current.

-

When a director moves home address a statutory form must be filed noting the new address and effective date of change.

-

The list of directorships should include all directorships held worldwide, past and present, within past 5 years.

-

Have the Financial Statements ready for filing.

-

Confirm the designated signatories for the Annual Return will be available to sign when required, i.e. a specific named Director and the Company Secretary.

Taking the above steps now can help to ensure there are no delays when it comes to filing the Annual Return.

One last thing – docu-signatures are not permitted on the Annual Return – you have been warned!

Check Yourself - Corporate Health

Everywhere we turn there seem to be advertisements advising us to check our personal health for this that and the other. No doubt all excellent advice but do we ever take time to check our corporate health as directors? It seems to me getting either one wrong will impact on us all to some extent.

There are no blood pressure cuffs when it comes to corporate health but there are a few checks we as director can all do to at least get started.

-

Management accounts – should be circulated and read by Directors on a regular basis.

-

Board meetings – should be held at least quarterly where Directors consider the overall direction of the company and do not get bogged down with the nitty gritty which is the role of the Management Team.

-

Chairperson – how is that role managed by the Board and by the Chairperson. He/she should be capable of ensuring all participants have an opportunity to be heard, and that meetings do not run on for ages. Unfortunately, we have all been at meetings where certain individuals like to hear their own voice no matter the relevance of their words.

-

Risk Register – does your company have one, and if not why not? A Risk Register (properly managed and regularly reviewed) can save an awful lot of headaches. For example, if you have a supply contract that has to be renewed annually you need to be able to negotiate this ahead of time and not after the event.

-

Insurance – when were the company insurance policies last reviewed and at what level of detail. It is always surprising how little directors know about insurance cover even on a basic level such as whether or not they are covered under their own company’s director and officer liability insurance.

-

Statutory filings – does the Board have a timetable of statutory filings even covering basic things such as filings with the Revenue Commissioners – Companies Registration Office – Central Registry of Beneficial Ownership.

Having the basics in place can help to ensure issues are dealt with in a timely manner with minimum fuss. Now don’t tell me that doesn’t help keep your blood pressure down!

Definition of a Charity Board Succession Plan

Definition of a Charity Board Succession Plan

A board succession plan is a document that sets out the process to be followed when a Charity Trustee resigns. It’s very useful to prepare for when a Trustee’s term limit is coming up or when a Trustee departs unexpectedly. The Charity Regulatory advise that a Trustee’s term should be no more than 9 years. They have recently issued excellent guidelines on Trustee Term Limits and Succession Planning, click here.

-

Induction

-

Induction should aim to introduce a new Trustee to the organisation, aims, values and provide an overview of the challenges its facing.

-

Understand their legal duties, responsibilities and personal liability.

-

A visit to the Charity and meet staff, volunteers, beneficiaries (if possible) and Trustees.

-

Provide an induction pack, to include set of financial statements, recent minutes, copy of strategic plan and budgets etc. Further information on an Induction Pack from Charity Regulatory Authority here.

Check out the Charity Regulatory Authority Guidance on Induction and Recruitment here

2. Identify Skills Required

This will vary, most charities will need Financial expertise for example. You will need to consider the experience you need, for example do you employ staff? If so, you will probably need HR expertise and support etc. This exercise is very helpful when you’re considering new Trustees

3. Skills Matrix

Circulate the Skills Matrix and ask your Trustees to complete (tick under the skills-sets they already have). You will find that there is a broad variety of skills and experience amongst the Board. Once this exercise is completed, you can easily identify the “gaps” which will help pinpoint the exact set of skills you’re looking for.

4. Review

Periodically review the Induction Process (with feedback from Trustees) and also periodically review the Skills Matrix, which will need to be adapted with the needs of your charity and Trustee changes etc.

Resources

The Charity Regulatory Authority have excellent resources available on their website, links are below.

Succession Planning click here

Induction Pack Checklist click here. Induction and recruitment click here

Are you a Member or a Shareholder?

A shareholder can be either an individual or a company. The rights of a shareholder vary depending on issues such as the company’s Constitution, Shareholder Agreements, type of shares, etc.

A company’s Constitution will spell out the type of authorised shares and specific rights attaching such as voting rights, dividend payments, etc. Unlike the Constitution which is a public document filed in the Companies Registration Office a Shareholder Agreement is private document. A Shareholders Agreement covers issues such as rights to shares, rights to nominate an individual to the Board of Directors, and funding.

When a company is incorporated Members appoint Directors to manage the company on their behalf. As and when the Directors approve and sign the Financial Statements they are then presented to the Shareholders at an Annual General Meeting. This is when Shareholders have an opportunity to question Directors on how they managed the Company during the year and what their plans are for future development.

If you are a Member / Shareholder make sure your details are accurately reflected in the Statutory Register of Members. Without your current details including your current home address the company has no way of contacting you which is much more likely going to be more of a loss to you then to the them.

Rectifying Statutory Registers and filings

The onus to ensure Statutory Registers are accurately maintained in a timely manner is a given but what happens if you make a mistake?

Mistakes happen and can usually be rectified. It is important to remember that if you have to rectify Statutory Registers you are more than likely going to have to rectify information already filed in the Companies Registration Office. (CRO).

Depending on what the mistake is and when it occurred you have to consider how to rectify it in a timely manner. For example, suppose you find a mistake today where in 2020 an allotment of 50,000 shares was incorrectly recorded as an allotment of 500 shares what do you do? There are a number of things to consider such as those outlined below.

-

Form B5 – form filed in the CRO noting allotment of shares. To amend the figure from 500 to 50,000 prepare and file a Form B42A.

-

Form B1 – Annual Return filed in the CRO which provides a snapshot of the company on a particular date. Check everything to do with the shares (share class, total number, and members) provided in each Annual Return filed from 2020 to date. If any of the information needs to be amended prepare and file Forms B1B for each of the relevant years.

-

Financial Statements – check if mistake impacts on financial statements. Financial Statements cannot be amended once they have been approved and signed by the Directors but, you should contact the Accountant/Auditor to notify them of the error so they can advise on what actions may be required when preparing the next set of Financial Statements.

-

Board Minute – it would be appropriate for the Directors to note at a Board Meeting that a mistake had been made and all necessary steps had been taken to rectify the situation.

I know the phrase “to err is human to forgive is divine” but there is no divinity when it comes company law. Sweeping a mistake under the carpet never works. Once a mistake has been identified take appropriate advice to ensure it is dealt with promptly and fairly.

Charities - Register of Beneficial Ownership

Background (Legislative)

All Irish companies are required by legislation (which came into effect in November 2016) to establish and maintain a “Register of Beneficial Owners”. This includes charities and non-profits which are “Companies Limited by Guarantee” (CLGs). This blog is written specifically for charities which are “CLGs”.

Purpose of Central Register

The purpose of the Central Register is to provide a central register of beneficial ownership of companies and industrial and provident societies.

Who has access to the Central Register?

The Central Register can be accessed by:

-

Criminal Assets Bureau;

-

Revenue Commissioners

-

Gardai Síochána

-

Office of Director of Corporate Enforcement

-

General Public (a Beneficial Ownership Report can be requested)

How to identify Beneficial Owner?

Definition of a beneficial Owner

“any natural person who ultimately owns or controls a legal entity through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in the relevant entity, or through control via other means”.

However, charities who are CLGs, don’t have beneficial owners in the conventional sense. The assets of the charity are held for its charitable purpose and the charity is run for the benefit of its beneficiaries. All CLGs are still legally obliged to submit the prescribed information to the Central Register. They are also required to hold an internal “Register of Beneficial Ownership”. The definition does not take into account that “ownership” or voting rights and so forth are solely for the benefit of the beneficiaries of the charity (it’s charitable purpose) and not in the interests of individual members.

Consequently, your charity needs to interpret this definition to establish how the legislation applies to and which individuals need to be classified.

The legislation determines that an “ownership” of over 25% defines a beneficial owner. Members of a CLG are determined to be the owners as they exercise control over the CLG by way of their right to vote at AGMs.

Three Members or less

Members are likely to qualify as “beneficial owners” if a CLG (charity) has three or less members. This is because each member has more than 25% of the voting rights. In this instance, details of the three members must be submitted to the Central Register and recorded on the company’s Internal Register of Beneficial Ownership.

Four Members or more

Most charities which are CLGs, have four or more members. The charity must diligently review whether there any individual (s) exercise indirect or direct voting rights or control over the charity. Check your Constitution and any other legal agreements in place to clarify membership). If any individual, other than a member or a senior managing official exercises control, they need to be recorded as a “Beneficial Owner”. The charity may not be able to identify a beneficial owner (having checked the Constitution and other agreements), because there are four or more members or control and voting rights are not exercised by other individuals.

In the majority of instances however, CLGs need to file prescribed information on their “Senior Managing Officials” on the Central Register of Beneficial Ownership and on an Internal Register of Beneficial Ownership.

A Senior Managing Official includes the Directors and the Chief Executive Officer.

Details to be filed on the Central Register

The prescribed information required for each Managing Official:

Name

Residential Address

Nationality Date of Birth

PPS Number

Nature and extent of the Interest held or control exercised (an opportunity to record the charitable status of the CLG)

Date the individual was added to the Register

Date of cessation on the Register

PPS number entered in the RBO portal must match the name as registered on their PPSN with the Department of Employment and Social Protection. The information is not verified against the Revenue Commissioners records. For example: “Paddy” might be recorded with DEASP as "Pat", Patrick” etc

You can ring DEASP at 1890 927 999 to check the exact name you're registered with DEASP (for PPSN)

In the unlikely event a Managing Official does not have a PPS number, they are required to complete a BEN2 Form (to verify their identity) which must be legally authenticated. Further information on BEN2 is here.

Maintain up-to-date details on the Central Register

It’s critical to keep the information up-to-date. Any changes to the Beneficial Owners must be recorded on the Central Register and also on the charity’s Internal Register of Beneficial Ownership.

Penalties for non-compliance

Legal entities (charities not exempt) who do not file are guilty of an offence and be liable on summary conviction to a Class A fine of up to €5,000 and on conviction on indictment to a fine of up to €500,000.

<< Previous page << Page 1 Page 2 Page 3 Page 4 >> Next page >>

Blog categories

- All Categories

- Boards

- Charities

- Companies Registration Office

- Company Law Review Group

- Company Registers

- Directors

- Meetings

- Latest News

- Annual Returns

- Beneficial Ownership (1)

Blog Archive

- April 2024 (1)

- March 2024 (2)

- February 2024 (2)

- January 2024 (1)

- December 2023 (2)

- November 2023 (1)

- October 2023 (3)

- July 2023 (1)

- June 2023 (1)

- May 2023 (2)

- April 2023 (2)

- February 2023 (2)

- January 2023 (1)

- November 2022 (3)

- September 2022 (2)

- August 2022 (1)

- View older Posts (105)