Archive November 2022

3 Posts , Viewing posts 1 to 3

The public can no longer access beneficial ownership information

One of the biggest talking points at the time the Beneficial Ownership Register was put in place was the fact that the public could access it. This meant the public could see the names of the beneficial owners, what percentage shareholding they might hold and even their dates of birth and home addresses!

All that has now changed further to an unexpected European Court Judgment last week. Its ruling means that from now on only 'Designated Persons' can search the Register and obtain beneficial ownership details.

From a practical point of view, the ruling will not affect the vast majority of companies. They are still obliged to ensure both their internal and external Beneficial Ownership Registers are completed in full and kept up to date. The banks as a 'Designated Person' will continue to be able to search the Register and (in our experience) refuse to/delay providing credit facilities to companies if they have queries over the information lodged.

In summary, even if Joe Public can no longer have a peep, there is still no excuse not to register your Beneficial Ownership information and keep it updated!

New Charities Classification System

Charities Classification System

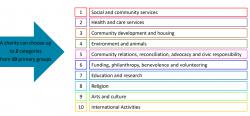

The Charities Regulatory Authority launched a Classification System on 14th November 2022 (as part of Charities Week) which broadly mirrors classification systems in other jurisdictions.

The purpose of the system is to improve functionality of the Charities Register, provide clarity on registered charities, improve data for research.

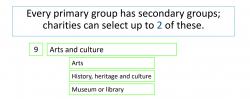

Charities to self-determine classification and rely on a “best fit” as it is not possible to achieve a perfect system. It is important to note that Classification will not put a limit on the types of activities a charity can carry out to further their charitable purpose.

How does it work?

In the example provided by the Charities Regulator, a museum for example would choose category “Arts and Culture” and can then select two secondary groups “History, heritage and culture” and “Museum or library”.

How to search charities using the classification System

A search facility will be introduced when the database is populated. This will be of benefit to funders, researchers and potential volunteers.

What should charities do now?

• Directors to agree on classification and record decision at a Board Meeting.

• Log into MyAccount to complete and submit form

• Once off process (unless charity wishes to amend it in future)

• Automatic registration of classification

• Immediate update to Register of Charities

More Information

There’s a new Classification Section on their website with more information which includes:

CORPORATE ENFORCEMENT AUTHORITY - different name – no difference?

The Corporate Enforcement Authority (established in July 2022) replaced the Office of Director of Corporate Enforcement (ODCE) which was no longer fit for purpose. With the creation of the CEA it would be easy to think same old, same old.

It seems to me that the CEA has seized the opportunity to morph into a much more dynamic, focused, and independent organisation which has hit the ground running. Personally, I think one of the most important developments for the CEA is its ability to control its own recruitment requirements so that it can source specialist staff capable of dealing with the intricacies of corporate crime.

White collar crime sounds quite bland but as far as I am concerned it is just as bad as any other crime. A corrupt director may not have physically knocked over an old lady to steal her handbag but stealing the old lady’s pension is worse. I was never a great advocate of the “walk of shame” one saw for alleged corporate criminals in other jurisdictions but, have to admit I am beginning to think there is some merit in seeing the public arrest with HANDCUFFS of individuals accused of corporate crime.

According to the United Nations it is estimated that US$1 trillion is paid in bribes and US$2.6 trillion stolen through corruption. Combined these sums represent 5% of annual Global Gross Domestic Product.

This year the Irish Government gave one of the biggest Budgets in the history of the State with commentators saying it was made possible by income from Corporation Tax. Whatever one thinks of the Budget if Ireland does not maintain a reputation as a strong reputable country to do business in there will be no Corporation Tax to argue about. There are more than enough challenges for Irish companies dealing with the devasting war in Ukraine, energy costs, housing, climate, etc. Without a strong corporate reputation Ireland will no longer attract business and once a reputation is lost the way back is grindingly hard for everyone.

An effective CEA will be to the benefit of us all.

Blog categories

- All Categories

- Boards

- Charities

- Companies Registration Office

- Company Law Review Group

- Company Registers

- Directors

- Meetings

- Latest News

- Annual Returns

- Beneficial Ownership (1)

Blog Archive

- April 2024 (1)

- March 2024 (2)

- February 2024 (2)

- January 2024 (1)

- December 2023 (2)

- November 2023 (1)

- October 2023 (3)

- July 2023 (1)

- June 2023 (1)

- May 2023 (2)

- April 2023 (2)

- February 2023 (2)

- January 2023 (1)

- November 2022 (3)

- September 2022 (2)

- August 2022 (1)

- View older Posts (105)