Charities

5 Posts , Viewing posts 1 to 5

The Charities (Amendment) Bill 2022

The Charities (Amendment) Bill 2022 was published by The Minister for Rural and Community Development, Heather Humphries on 29 April 2022. The purpose of the Bill is “to provide for a number of amendments to the Charities Act 2009. The proposed amendments aim to improve the ability of the Charities Regulator to conduct its statutory functions, ensuring more proportionate regulation leading to greater public trust and confidence in the charities sector.” The Bill is expected to be enacted later this year.

Some of the provisions include the following;

-

Establish the promotion of human rights as a charitable purpose.

-

Increase the threshold for filing of a full set of Financial Statements from a maximum gross income or expenditure of €100,000 to €250,000 (aligning with the Companies Act 2014).

-

The accounting standard “Charities Statement of Recommended Practices (SORP)” will be compulsory. An exemption will be permitted for charities with a turnover of less than €250,000.

-

Definition of charities trustee to be amended to exclude Company Secretaries (who hold no other office in the charity).

-

Introduction of new statutory fiduciary duties for trustees to act in good faith, avoid conflicts of interest and exercise an objective standard of care, skill and diligence when advancing the charitable purpose of the charity, mirroring similar duties of Directors under the Companies Act 2014.

-

New Definition of the term “Member”. This change extends the requirement to maintain a Register of Members to unincorporated associations.

Click here for full text of the Charities (Amendment) Bill 2022

New Charities Classification System

Charities Classification System

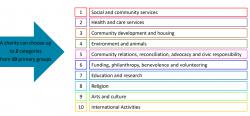

The Charities Regulatory Authority launched a Classification System on 14th November 2022 (as part of Charities Week) which broadly mirrors classification systems in other jurisdictions.

The purpose of the system is to improve functionality of the Charities Register, provide clarity on registered charities, improve data for research.

Charities to self-determine classification and rely on a “best fit” as it is not possible to achieve a perfect system. It is important to note that Classification will not put a limit on the types of activities a charity can carry out to further their charitable purpose.

How does it work?

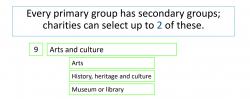

In the example provided by the Charities Regulator, a museum for example would choose category “Arts and Culture” and can then select two secondary groups “History, heritage and culture” and “Museum or library”.

How to search charities using the classification System

A search facility will be introduced when the database is populated. This will be of benefit to funders, researchers and potential volunteers.

What should charities do now?

• Directors to agree on classification and record decision at a Board Meeting.

• Log into MyAccount to complete and submit form

• Once off process (unless charity wishes to amend it in future)

• Automatic registration of classification

• Immediate update to Register of Charities

More Information

There’s a new Classification Section on their website with more information which includes:

Definition of a Charity Board Succession Plan

Definition of a Charity Board Succession Plan

A board succession plan is a document that sets out the process to be followed when a Charity Trustee resigns. It’s very useful to prepare for when a Trustee’s term limit is coming up or when a Trustee departs unexpectedly. The Charity Regulatory advise that a Trustee’s term should be no more than 9 years. They have recently issued excellent guidelines on Trustee Term Limits and Succession Planning, click here.

-

Induction

-

Induction should aim to introduce a new Trustee to the organisation, aims, values and provide an overview of the challenges its facing.

-

Understand their legal duties, responsibilities and personal liability.

-

A visit to the Charity and meet staff, volunteers, beneficiaries (if possible) and Trustees.

-

Provide an induction pack, to include set of financial statements, recent minutes, copy of strategic plan and budgets etc. Further information on an Induction Pack from Charity Regulatory Authority here.

Check out the Charity Regulatory Authority Guidance on Induction and Recruitment here

2. Identify Skills Required

This will vary, most charities will need Financial expertise for example. You will need to consider the experience you need, for example do you employ staff? If so, you will probably need HR expertise and support etc. This exercise is very helpful when you’re considering new Trustees

3. Skills Matrix

Circulate the Skills Matrix and ask your Trustees to complete (tick under the skills-sets they already have). You will find that there is a broad variety of skills and experience amongst the Board. Once this exercise is completed, you can easily identify the “gaps” which will help pinpoint the exact set of skills you’re looking for.

4. Review

Periodically review the Induction Process (with feedback from Trustees) and also periodically review the Skills Matrix, which will need to be adapted with the needs of your charity and Trustee changes etc.

Resources

The Charity Regulatory Authority have excellent resources available on their website, links are below.

Succession Planning click here

Induction Pack Checklist click here. Induction and recruitment click here

Charities - Register of Beneficial Ownership

Background (Legislative)

All Irish companies are required by legislation (which came into effect in November 2016) to establish and maintain a “Register of Beneficial Owners”. This includes charities and non-profits which are “Companies Limited by Guarantee” (CLGs). This blog is written specifically for charities which are “CLGs”.

Purpose of Central Register

The purpose of the Central Register is to provide a central register of beneficial ownership of companies and industrial and provident societies.

Who has access to the Central Register?

The Central Register can be accessed by:

-

Criminal Assets Bureau;

-

Revenue Commissioners

-

Gardai Síochána

-

Office of Director of Corporate Enforcement

-

General Public (a Beneficial Ownership Report can be requested)

How to identify Beneficial Owner?

Definition of a beneficial Owner

“any natural person who ultimately owns or controls a legal entity through direct or indirect ownership of a sufficient percentage of the shares or voting rights or ownership interest in the relevant entity, or through control via other means”.

However, charities who are CLGs, don’t have beneficial owners in the conventional sense. The assets of the charity are held for its charitable purpose and the charity is run for the benefit of its beneficiaries. All CLGs are still legally obliged to submit the prescribed information to the Central Register. They are also required to hold an internal “Register of Beneficial Ownership”. The definition does not take into account that “ownership” or voting rights and so forth are solely for the benefit of the beneficiaries of the charity (it’s charitable purpose) and not in the interests of individual members.

Consequently, your charity needs to interpret this definition to establish how the legislation applies to and which individuals need to be classified.

The legislation determines that an “ownership” of over 25% defines a beneficial owner. Members of a CLG are determined to be the owners as they exercise control over the CLG by way of their right to vote at AGMs.

Three Members or less

Members are likely to qualify as “beneficial owners” if a CLG (charity) has three or less members. This is because each member has more than 25% of the voting rights. In this instance, details of the three members must be submitted to the Central Register and recorded on the company’s Internal Register of Beneficial Ownership.

Four Members or more

Most charities which are CLGs, have four or more members. The charity must diligently review whether there any individual (s) exercise indirect or direct voting rights or control over the charity. Check your Constitution and any other legal agreements in place to clarify membership). If any individual, other than a member or a senior managing official exercises control, they need to be recorded as a “Beneficial Owner”. The charity may not be able to identify a beneficial owner (having checked the Constitution and other agreements), because there are four or more members or control and voting rights are not exercised by other individuals.

In the majority of instances however, CLGs need to file prescribed information on their “Senior Managing Officials” on the Central Register of Beneficial Ownership and on an Internal Register of Beneficial Ownership.

A Senior Managing Official includes the Directors and the Chief Executive Officer.

Details to be filed on the Central Register

The prescribed information required for each Managing Official:

Name

Residential Address

Nationality Date of Birth

PPS Number

Nature and extent of the Interest held or control exercised (an opportunity to record the charitable status of the CLG)

Date the individual was added to the Register

Date of cessation on the Register

PPS number entered in the RBO portal must match the name as registered on their PPSN with the Department of Employment and Social Protection. The information is not verified against the Revenue Commissioners records. For example: “Paddy” might be recorded with DEASP as "Pat", Patrick” etc

You can ring DEASP at 1890 927 999 to check the exact name you're registered with DEASP (for PPSN)

In the unlikely event a Managing Official does not have a PPS number, they are required to complete a BEN2 Form (to verify their identity) which must be legally authenticated. Further information on BEN2 is here.

Maintain up-to-date details on the Central Register

It’s critical to keep the information up-to-date. Any changes to the Beneficial Owners must be recorded on the Central Register and also on the charity’s Internal Register of Beneficial Ownership.

Penalties for non-compliance

Legal entities (charities not exempt) who do not file are guilty of an offence and be liable on summary conviction to a Class A fine of up to €5,000 and on conviction on indictment to a fine of up to €500,000.

Charities Are your Trustee Details up-to-date with the Charity Regulator?

All charities must ensure that details are up-to-date and accurate with the Register of Charities. Trustees are legally obliged to ensure information on the Register of Charities is accurate.

If you are a charity Trustee, you can check the register very easily, click on this link, enter the name of your charity, click onto the charity name when prompted and click the “People” tab. There you will see the names of Trustees, appointment date and years of service.

Check with your charity, that the contact details recorded for you are correct.. The Charity Regulatory uses the information recorded to communicate essential information, if they don’t have the relevant contact details you are missing out on important guidance and correspondence from them.

In their last ezine, the Charity Regulator requested all Trustees to check and update if necessary. To do this log into your MyAccount and check that the following details are correct:

-

Registered postal address

-

Email address

-

Telephone number

If you’re having any issues, you phone the Charity Regulatory Authority 0818 927999 or email info@charitiesregulator.ie., their phone lines are manned Monday to Friday between 11am-3pm

Blog categories

- All Categories

- Boards

- Charities

- Companies Registration Office

- Company Law Review Group

- Company Registers

- Directors

- Meetings

- Latest News

- Annual Returns

- Beneficial Ownership (1)

Blog Archive

- April 2024 (1)

- March 2024 (2)

- February 2024 (2)

- January 2024 (1)

- December 2023 (2)

- November 2023 (1)

- October 2023 (3)

- July 2023 (1)

- June 2023 (1)

- May 2023 (2)

- April 2023 (2)

- February 2023 (2)

- January 2023 (1)

- November 2022 (3)

- September 2022 (2)

- August 2022 (1)

- View older Posts (105)